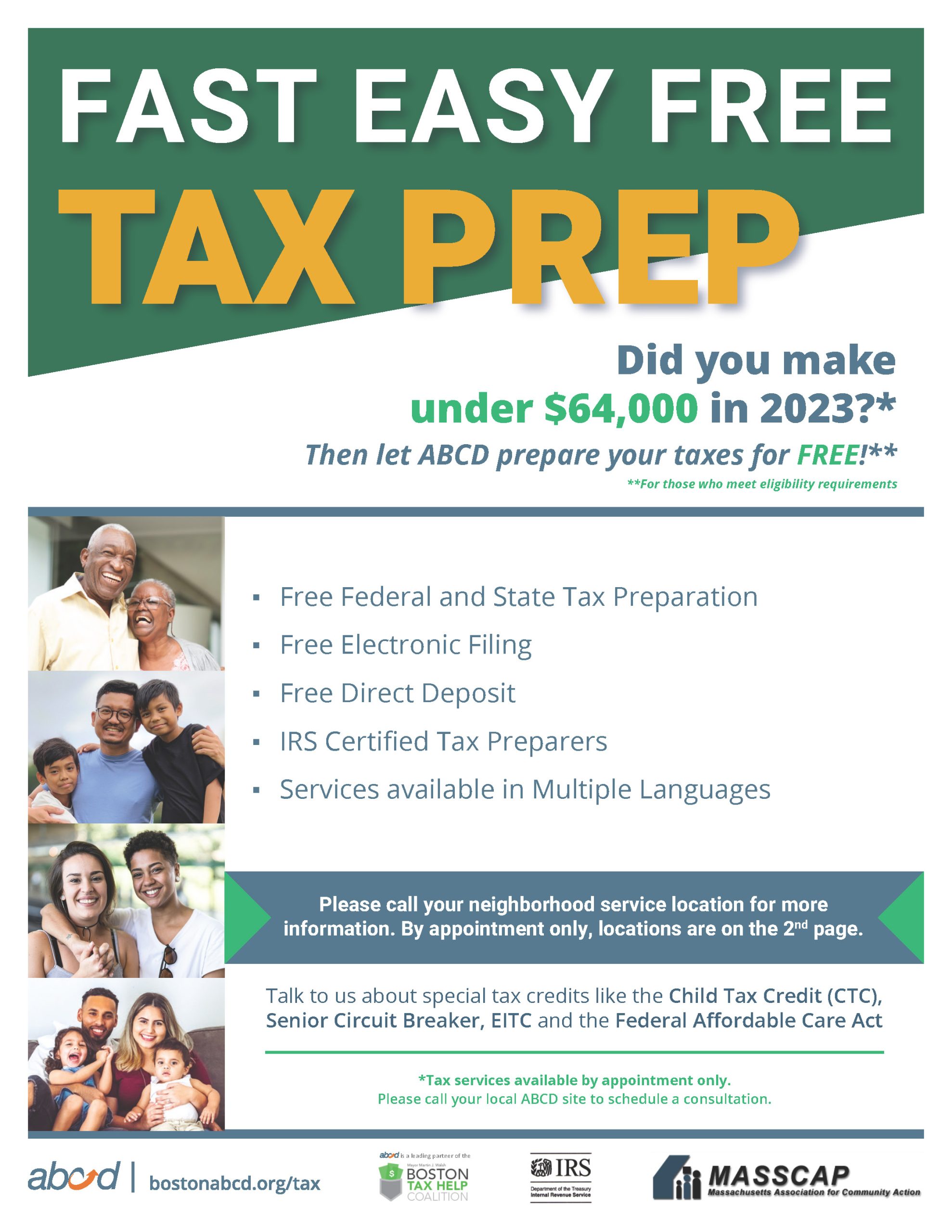

Tax Assistance

If you qualify, we provide you with free tax preparation assistance that can help reduce your tax burden and get back money that can help you pay off debt and build savings.

Who Qualifies?

We provide free tax assistance if you’re income eligible and meet a few other requirements. For instance, if you earned less than $64,000 in 2023, you may qualify!

Get the refund you’ve earned

In 2023, 30 IRS-certified ABCD volunteers working at 11 of our neighborhood sites and two satellite locations submitted 3,103 state and federal tax returns which generated $5,395,219 in refunds. A total of 488 individuals filed for the Earned Income Tax Credit and 384 filed for the Child Tax Credit.

As a leading partner of the Volunteer Income Tax Assistance (VITA) program and the City of Boston’s Tax Help Coalition, ABCD provides low and medium income Boston area residents with free electronic Federal and Massachusetts state tax preparation.

Our VITA volunteers are IRS-certified annually and are trained to assist you in finding all the tax credits you deserve—including those you may not have known you were even eligible for like the Earned Income Tax Credit (EITC).

We also provide these services to people with disabilities and limited English speaking taxpayers who need assistance in preparing their own tax returns. In fact, services are available in many languages.

In addition to VITA, the Tax Counseling for the Elderly (TCE) program offers free tax help for all taxpayers, particularly those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors. That includes the Massachusetts Senior Circuit Breaker tax credit, which allows taxpayers age 65 or older who own or rent residential property in Massachusetts a credit relating to the amount of real estate taxes paid on the property.

We also encourage you to ask about the Financial Check Up, which was developed by our partner, the Boston Tax Help Coalition. If you’re a Boston resident, this one-on-one financial assessment offers the opportunity to review your credit report with a trained financial guide and learn how to improve that credit over time.

Tax services are still available by appointment at the ABCD Mattapan Family Service Center and ABCD South End Neighborhood Service Center.

Federal tax deadline: April 17, 2024

Massachusetts tax deadline: April 17, 2024

DON’T FORGET TO HAVE READY:

- Valid Government Issued Photo ID

- Social Security card or Individual Taxpayer ID Letter (ITIN) for you, your dependents and/or your spouse

- All 1099 forms – 1099G (unemployment), 1099R (pension payments), 1099INT (bank interest), 1099SSA (Social Security), 1099 NEU

- All W2 forms from all jobs for 2023

- Proof of health insurance (health insurance cards, 1099-HC, 1095-A, etc.) for taxpayer, spouse, and all dependents**

- Total child care expenses in 2023, and child care provider’s name, address, and Employer Identification Number (EIN) or SSN

- All 1098T forms (tuition payments), receipts for materials and books and bursar statement

- Total student loan interest paid (1098E)

- A copy of last year’s tax return

- Bank issued printed account and routing numbers for direct deposit of your tax refund (for both checking and savings account)

- Proof of ANY deductible out of pocket expenses (annual BWSC, 1098E, charitable receipts, etc.)

- Any mail from the Massachusetts Department of Revenue (DOR)

- Any mail from the IRS

**Taxpayers who have received or expect to receive health insurance credits need to bring proof of ALL household income.

Without all documents, we cannot complete your tax returns.

TO MAKE AN APPOINTMENT TO SEE IF YOU QUALIFY FOR FREE TAX PREPARATION, contact your nearest ABCD Neighborhood Center.

ABCD Tax Flyer

English

Español (Spanish)

Kreyòl ayisyen (Haitian Creole)

简体中文 (Simplified Chinese)

繁體中文 (Traditional Chinese)

Portuguese

Vietnamese

WANT TO HELP? BECOME A VITA VOLUNTEER

Spend a few hours a week providing free tax preparation assistance to low to moderate \income families in your community—and make all the difference. Your training is free, and you’ll become an IRS-certified tax preparer, thanks to the federal Volunteer Income Tax Assistance (VITA) program.