In this bilingual explainer, NBC10 Boston and Telemundo NI break down what you need to know to get started on your taxes, including where to go if you need some help

It’s tax season, and as paperwork starts coming in knowing exactly what you need to file can save you time and frustration.

First of all, it’s important to know if you’re even required to file. In Massachusetts, full-time residents with a gross income over $8,000 as an individual must file a state tax return for 2022. For federal taxes, the minimum for an individual starts at $12,950. But if you’re considered self-employed, the filing requirements may look different. For a full breakdown of the income requirements for other scenarios, click here for state requirements and click here for federal.

If you’ve earned less than that filing may not be required, but there can be benefits to doing so.

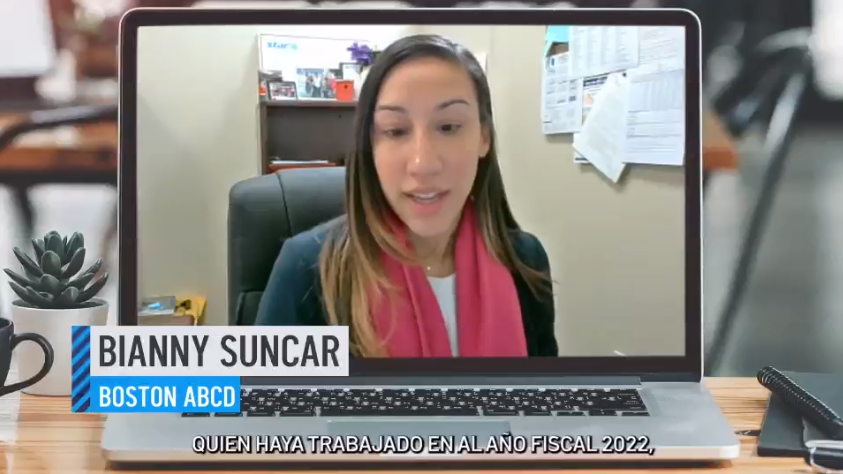

“Anybody who works in tax year 22, which is last year that we’re doing, received any tax forms, any, any income. You are welcome to file taxes, to claim any eligible credits and also to get any withholdings back,” explained Bianny Suncar of Action for Boston Community Development, which offers free tax preparation services to eligible residents.

…